TOPIC: PROFIT AND LOSS

REFERENCE BOOK: Macmillan Progressive Mathematics for JS2 Page 23

BEHAVIOURAL OBJECTIVES: At the end of this lesson, students should be able to:

(1) Explain the meaning of profit

(2) Explain the meaning of loss

(3) Solve problems on profit and loss.

CONTENTS

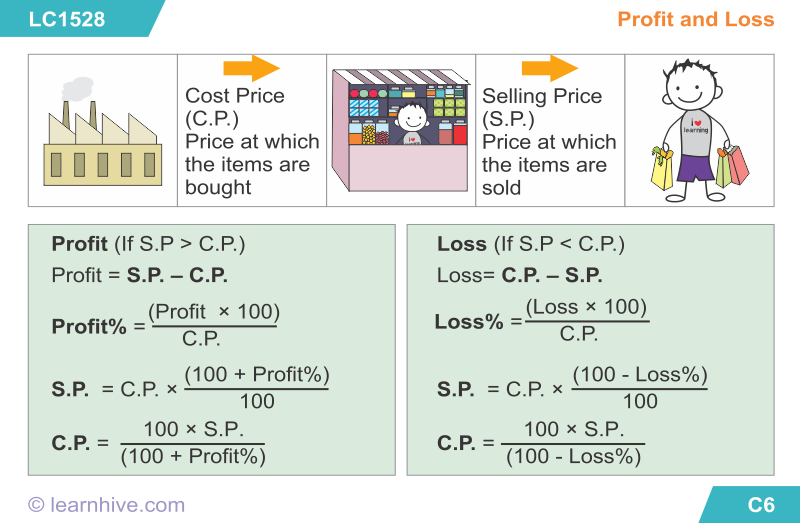

Profit is the amount realized over the cost price of an item.

(1) Profit = Selling price - cost price

(2) Selling price = cost price + profit

(3) Cost price = selling price - profit

(4) Loss = cost price - selling price

EXAMPLE 1:

An article was bought for #200 and sold for #250. What is the profit?

Cost price = #200.

Selling price = # 250

Profit = SP - CP

#250 - #200

#50

EXAMPLE 2:

A radio which cost #3000 was sold at a profit of #600. Find the selling price.

Selling price = CP + PROFIT

Cost price = #3000

Profit = #600

Selling price = #3000 + #600

#3600

EXAMPLE 3

An article was sold for #1500 at a profit of #200. Find the cost price.

Cost price = SP - PROFIT

= #1500 - #200

= #1300

Loss = cost price - selling price

Example : A man bought a dozen mangoes for #180 and sold each of them for #10. Find the loss.

solution

Cost price = #180

Selling price = 12 x #10

= #120

Loss = #180 - #120

= #60

https://youtu.be/1nuRxCEe9m8

EVALUATION: Macmillan Progressive Mathematics for JS2 Page 24 Exercise 3 Questions 1, 2 and 7

ASSIGNMENT: Answer questions 8, 9 and 10 from Macmillan Progressive Mathematics 2, Page 24 Exercise 3.

further studies

Study More...

Study More...

LESSON 38

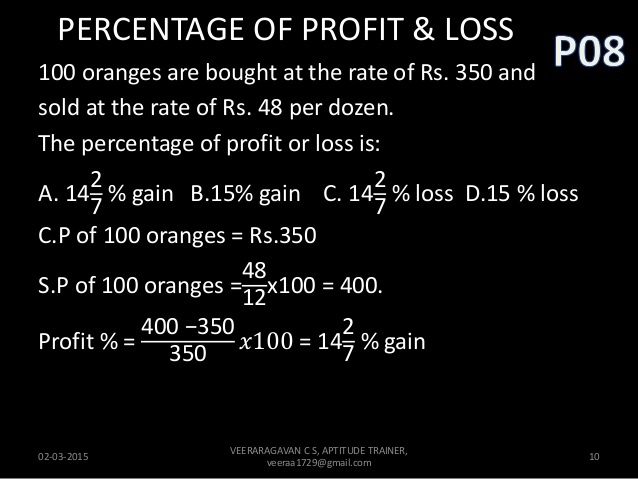

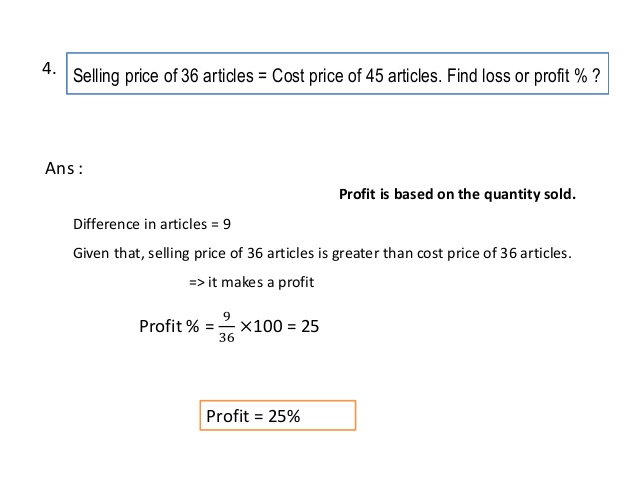

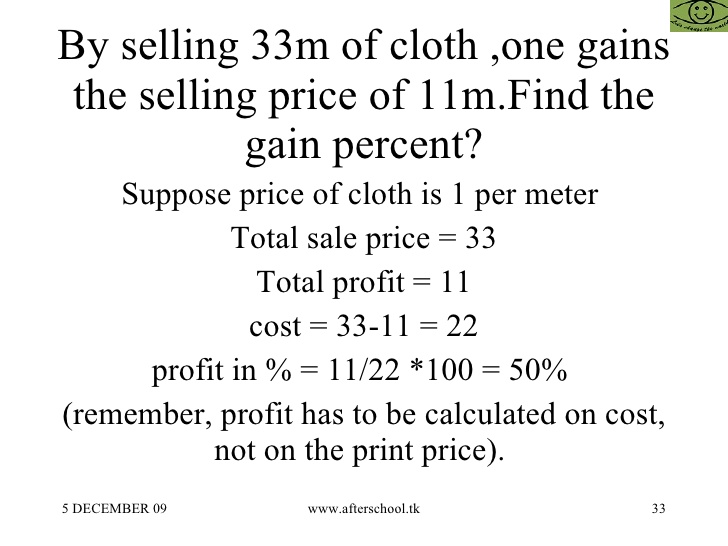

TOPIC: Percentage profit or loss

REFERENCE BOOK: Mathematics Inside Out Page 121

BEHAVIOURAL OBJECTIVES: At the end of this lesson, students should be able to:

(1) Find percentage profit

(2) Find percentage loss.

CONTENTS

Example:

Percentage profit = gain/cost price x 100

Percentage loss = loss/cost price x 100

Example 1:

A man bought a bag for #250 and sold it for #300. Find the gain %

Cost price = #250

Selling price = #300

Gain =#300 - #250 = #50

% gain = 50/250 x 100%

20%

Example 2:

An article was bought for #500 and sold for #450. Find the loss%

Cost price = #500

Selling price = #450

Loss = #50

Loss% = 50/500 x 100%

10%

https://youtu.be/drTcDXUUyTY

EVALUATION: Mathematics Inside Out Page 122, exercise 14.9, questions 5, 6 and 7.

ASSIGNMENT: Answer questions 2, 3 and 4 from Mathematics Inside Out, Page122, exercise 14.9

further studies

Study More...

Study More...

LESSON 39

TOPIC: Finding the cost price when given the selling price and gain or loss%

REFERENCE BOOK: Mathematics Inside Out, Page 123

BEHAVIOURAL OBJECTIVES: At the end of this lesson, students should be able to calculate the cost price given selling price and gain or loss%

CONTENTS

Example: What is the cost price of an article, given the selling price and gain% as #40 and 25% respectively?

Selling price = #40

Gain% = 25%

X = 100% + 25% = 125

CP/40 = 100/125

125CP = 40 x 100

CP = 4000/125 = #32

EXAMPLE 2

By selling an article for #35, a trader loses 30%. How much did he buy it?

Selling price = #35

Loss% = 30%

X = 100% - 30% = 70%

CP/35 = 100/70

70CP = 3500

CP = 3500/70

CP = #50

https://youtu.be/bOpjE42tKVk

EVALUATION: Answer questions 2 and 9 from Mathematics Inside Out Page 124.

ASSIGNMENT: Answer questions 3 and 8 from Mathematics Inside Out Page 124

LESSON 40

TOPIC: Finding the selling price when the cost price and gain or loss% are given.

REFERENCE BOOK: Mathematics Inside Out, Page 124.

BEHAVIOURAL OBJECTIVES: At the end of this lesson, students should be able to find the selling price when cost price and gain or loss% are given.

CONTENTS

Example

Find the selling price of an article which was bought for #600 and sold at a loss of 25%.

Cost price = #600

Loss% = 25%

X = 100% - 25%

X = 75

600/SP = 100/75

100SP = 600 X 75

SP = #450

EXAMPLE 2

A trader bought an article for #75 and sold it at a profit of 24%. Find the selling price.

Cost price = #75

Gain% = 24%

X = 100% + 24%

X = 124

75/SP = 100/124

100SP = 75 X124

SP = 9300/100

SP = #93

https://youtu.be/S_cIRSM5bQE

EVALUATION Answer questions 6 and 7 from Mathematics Inside Out, Page 124.

ASSIGNMENT Answer questions 8 and 9 from Mathematics Inside Out, Page 124.